Performance comparison of different asset classes

This article examines the performance of different asset classes over the past 10 years: equities, government bonds, corporate bonds, gold

Wednesday, 16 March 2022

How much would I have made in 10 years investing € 10000 on an equally-weighted portfolio consisting of the major asset classes?

Let’s see with this analysis carried out on the following instruments:

- Equity: 25%

- Government bond: 25%

- Corporate bond: 25%.

- Gold: 25%

Investment simulation over the last 10 years –> PIC Simulator

From the following table we can see that the maximum drawdown of the portfolio corresponds to the Covid-19 period, with the minimum of -17.84% reached on 18-03-2020. The final value after 10 years has almost doubled, with a performance of around 90%.

| Total Amount Invested | Final Portfolio Value | Profit | Volatility | Annualised Return | Maximum Drawdown |

|---|---|---|---|---|---|

| 10000€ | 18885.54€ | 88.86% | 7.1% | 6.2% | -17.84% in data 2020-03-18 |

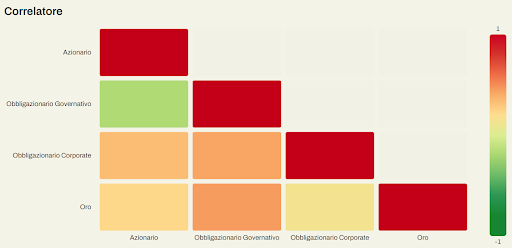

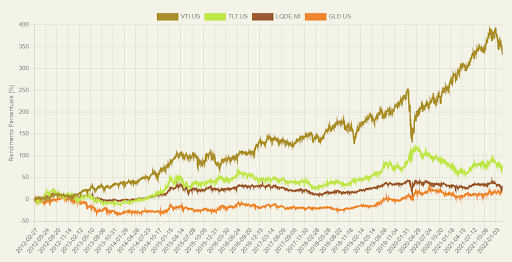

Percentage performance comparison –> Comparator

The comparison analysis shows how predictably over a 10-year period the equity component outperforms the other asset classes with the obvious disadvantage of higher volatility and higher drawdowns.

| Asset | Performance (10 years) |

|---|---|

| US Equity ETF | 331.27% |

| US 20-Year Government Bond ETF | 76.16% |

| US Corporate Bond ETF | 28.82%. |

| Gold ETF | 19.3% |