Comparison of the 5 most capitalized companies by sector in the S&P500

In this article we go over the performance, performance of a $1,000 investment, correlation and other statistics of the top 5 capitalized companies by sector in the S&P500 over the past 10 years: technology, healthcare, energy, consumer goods and finance

Wednesday, 30 March 2022

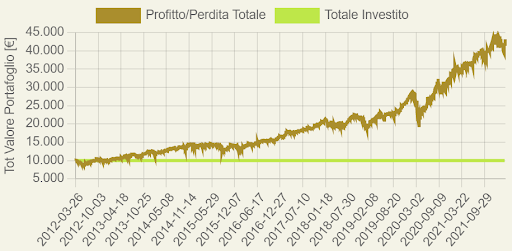

10000€ investment simulation over the last 10 years –> PIC simulator.

From the following graph and table we note that the maximum drawdown of the portfolio corresponds to the Covid-19 period, with the minimum of -32.96% touched on 23-03-2020. The final value after 10 years has more than quadrupled, with a performance of about 330%.

| Total Amount Invested | Final Portfolio Value | Profit | Volatility | Annualized Return | Maximum Drawdown |

|---|---|---|---|---|---|

| 10000€ | 43177.71€ | 331.78% | 17% | 17.6% | -32.96% on 2020-03-23 |

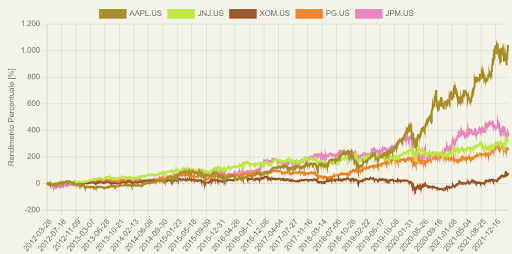

But who performed better among the 5? –> Comparator

Comparison analysis shows that over a 10-year period, Apple has clearly outperformed the other stocks by actually increasing its value tenfold, however, against more pronounced volatility. Volatility not to be underestimated for JPMorgan as well. Johnson & Johnson and Procter & Gamble had more linear growth while ExxonMobil “suffered” more than the other stocks.

| Asset | Performance (10 years) |

|---|---|

| Apple | 1012.6% |

| JPMorgan Chase | 391.75% |

| Johnson & Johnson | 336.76% |

| Procter & Gamble | 250.45% |

| ExxonMobil | 62.23% |

And from an ESG perspective, how is such a portfolio positioned?

The ESG tachometer positions the portfolio on an intermediate-high ESG risk level.

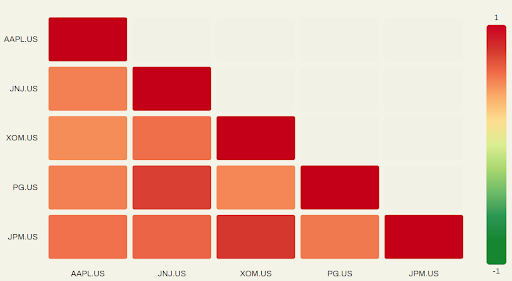

Securities correlation matrix –> Correlator.

The following correlation matrix shows that all stocks are positively correlated. The least correlated pair is Exxon/Apple which records a positive correlation of 0.31.

Conclusions.

The analysis was carried out on a portfolio in which the underlyings are equally weighted at 20 percent and are part of the same stock index: the S&P500. Despite the attractive returns achieved over the past 10 years, mainly driven by Apple stock, such a portfolio is poorly diversified and very volatile, having only a sector component as an element of diversification. The ESG profile of such a portfolio is at an intermediate-high level.