Fear Greed Index: the indicator that reveals market sentiment

Today we look at this index that measures market sentiment and try to understand how it can be exploited in times of particular market turmoil

Sunday, 23 April 2023

The financial market is a volatile and unpredictable environment, often driven by investors’ emotions. Although rationality should guide investors’ choices, the reality is that emotions can prevail, leading to irrational decisions and extreme price movements. But how can we understand the mood of the financial market? This is where the Fear Greed Index comes in.

What is the Fear Greed Index?

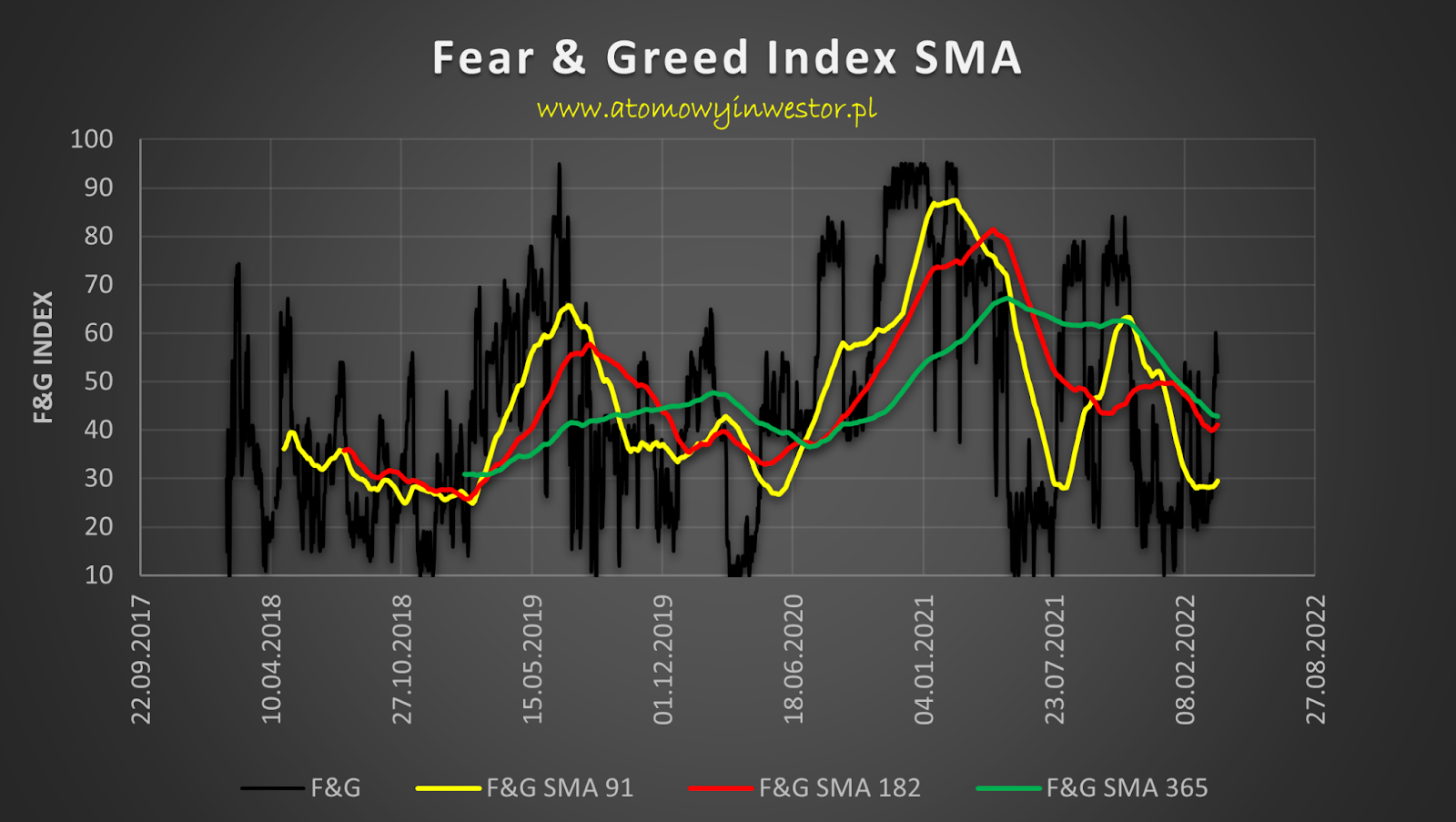

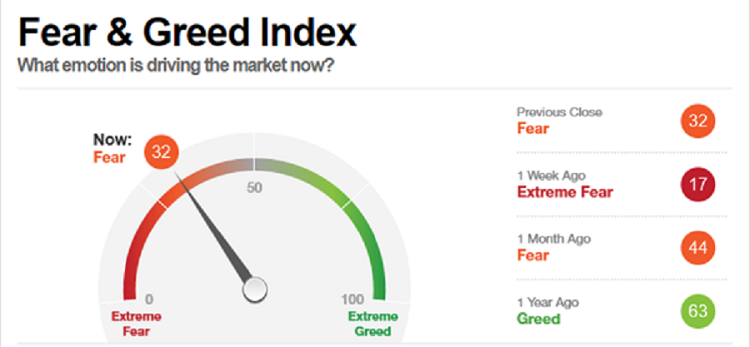

The Fear Greed Index, or Fear Greed Index, is an indicator developed by CNN Money that seeks to measure US stock market sentiment. The index is made up of seven different indicators, including market volatility, change in stock prices, money inflow into the economy, change in the ratio of rising to falling stocks, and other related factors. The index provides a score between 0 and 100, where a score of 0 indicates maximum market fear and a score of 100 indicates maximum market greed.

How does the Fear Greed Index work?

The Fear Greed Index is based on a simple premise: when investors are fearful of the market, they sell their shares and the share price falls. When investors are greedy, they buy stocks and the share price rises. The index uses the seven indicators to assess market sentiment and assign a score.

For example, a score of 0 indicates that investors are very fearful and the market is very volatile, while a score of 100 indicates that investors are very greedy and the market is very stable. Although the Fear Greed Index was developed for the US stock market, the concept of measuring market sentiment can be applied to any financial market.

How to use the Fear Greed Index?

The Fear Greed Index can be used as a technical analysis tool to assess market sentiment and predict possible price movements. If the index score is high, for example, it could indicate that the market is overly reckless and a price correction could occur. On the other hand, if the score is low, it could indicate that the market is overly pessimistic and there could be a buying opportunity.

In summary, the Fear Greed Index is a useful tool for understanding financial market sentiment and predicting possible price movements. However, it is important to remember that the index is not infallible and the market can be influenced by many different factors. As always, it is important to use the index in combination with other analysis and investment strategies to make informed and rational decisions.

By using the Fear Greed Index as a technical analysis tool, investors can avoid being influenced by market emotions and make more considered investment decisions. For example, if the index shows that the market is overly greedy, investors may decide to sell some of their positions to limit the risk of any price corrections.

Furthermore, investors can use the index as a risk management tool, monitoring the index score to assess the general market trend and adopting appropriate investment strategies accordingly.

In conclusion, the Fear Greed Index is a useful tool for investors seeking to understand financial market sentiment. Due to its simplicity and ability to provide an immediate indication of market sentiment, the index can be used as part of a technical analysis strategy to make more informed and rational investment decisions. However, as always, it is important to use the index in combination with other analysis and investment strategies to make informed and rational decisions.

Disclaimer

This article is not financial advice but an example based on studies, research and analysis conducted by our team.

Discover how easy it is to replicate this analysis and many other investment strategies in the Wallible app. With free registration you get access to all the tools.

Sign up for free