Portfolio liquidity management

When to use Account Operations and how they affect NAV and cash.

Because liquidity matters

A properly tracked cash balance makes NAV realistic and returns reliable. If you neglect deposits/withdrawals, your portfolio risks showing distorted performance compared to your actual situation.

When to use Account Operations

- Do you want the real cash balance? Record each deposit/withdrawal in “Account Operations”: NAV and returns will only use this cash register.

- Don’t need to track the checkout? Do not enter Account Transactions (either from file or manually): Wallible will use the trades to derive the necessary flows.

Key rule

- If you use Account Operations orders must use recorded available liquidity (deposits = positive balance, withdrawals = negative balance).

- If you do not use Account Operations the cash balance is virtual and adapts to orders; No deposits/withdrawals are required.

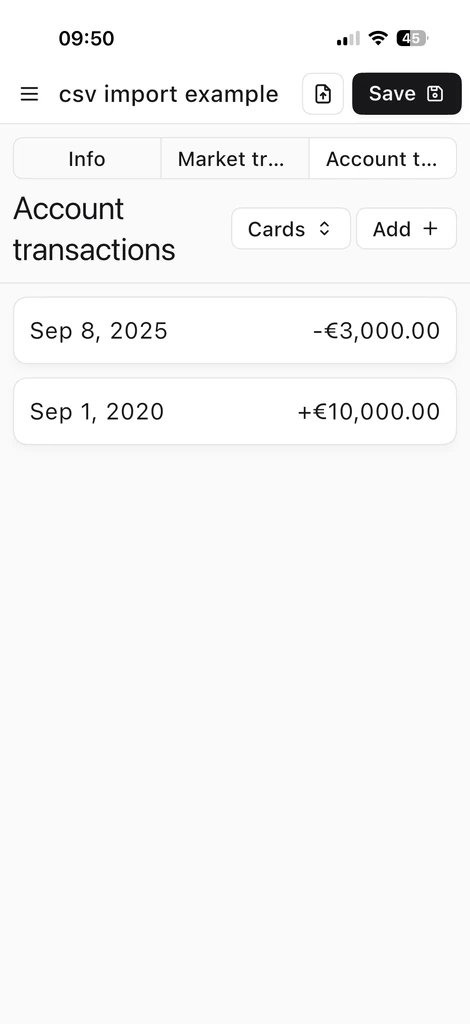

How to register cash (Deposits/Withdrawals)

- Portfolio “Account Operations” tab.

- Add movement: date/time, type (Deposit/Withdrawal), amount, currency (default that of the portfolio).

- Save: deposit increases cash, withdrawal reduces it.

Visual example

Loading insights

- To load flows from files, see Load transactions and account operations from csv files.

- To enter flows manually, see Load Transactions and Account Operations Manually.

New to Wallible? Register for free to start tracking your cash flows immediately and see the real NAV of your portfolio.

Sign up for free