Blog

Analysis, discussions and concepts in the financial environment

Is the stock market overvalued or undervalued? It's a question that lingers in the minds of investors and financial enthusiasts alike. In this …

Options are powerful financial instruments that provide investors with flexibility and potential profit opportunities. Whether you're a seasoned …

Investing is an important way to grow wealth over time, but it can be risky. The key to successful investing is understanding your own risk tolerance, …

Investment portfolio management is an essential aspect of financial planning, and investors must make informed decisions to optimize their returns. …

When it comes to investing, there are two main approaches to analyzing stocks and other financial assets: fundamental analysis and technical analysis. …

When evaluating a company, one of the most important factors to consider is its ability to generate cash flow. However, it is not just the amount of …

Maximum Drawdown (MDD) is a popular metric used by investors to assess the risk associated with an investment portfolio. It measures the largest …

Here are the top 5 ETFs for investing in megatrends.These trends can present unique opportunities for investors to generate long-term growth and …

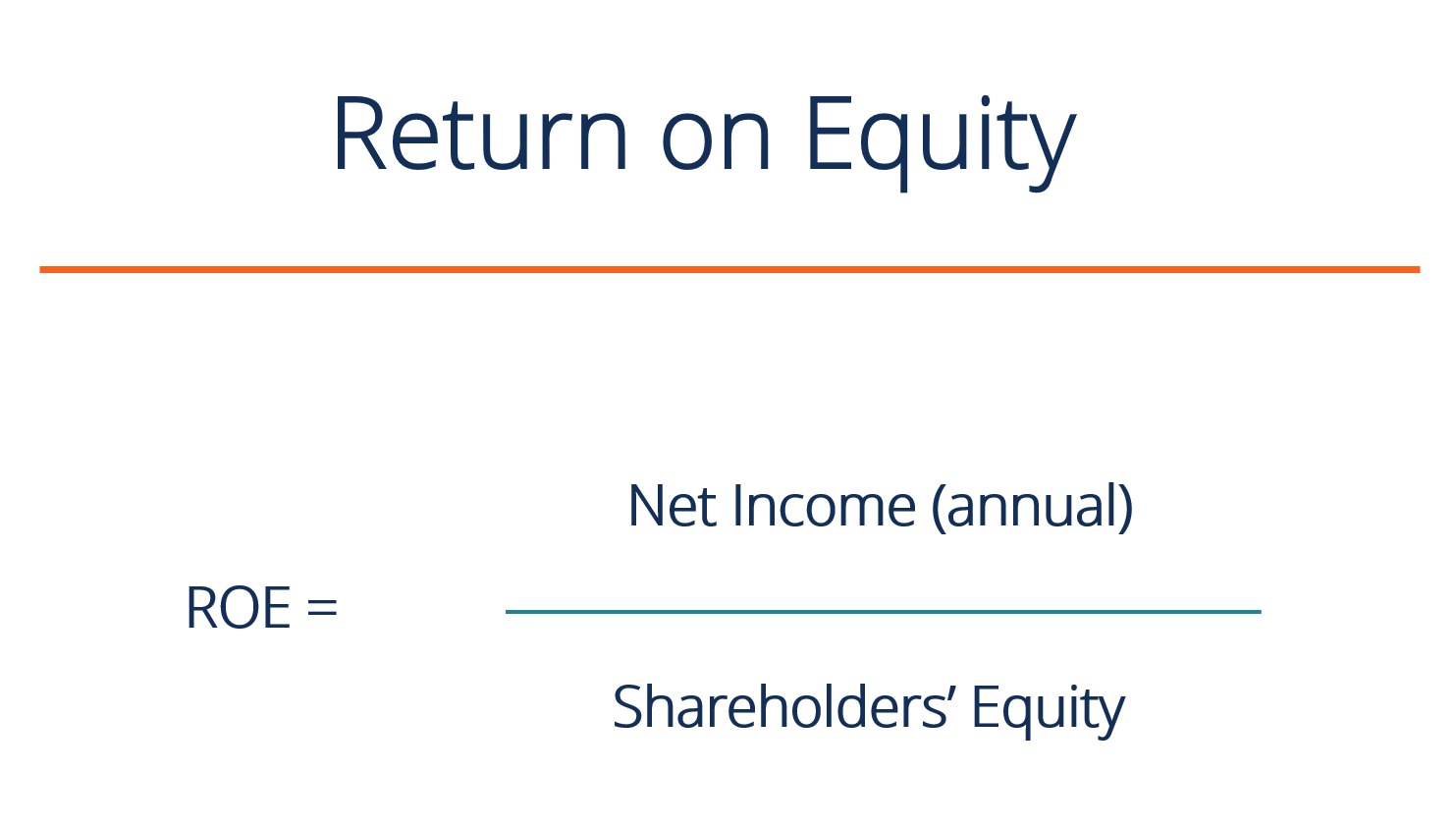

ROE is an important valuation metric because it indicates how efficient the company is in the use of its capital. A company with a high ROE indicates …

Interest rate developments are a key factor influencing all financial markets, including the credit and 'distressed debt' markets. In this article, we …

Leverage is a technique used by investors to increase the potential return on their investments. In simple terms, leverage means using borrowed funds …

Let's see what compound interest is and how it affects the exponential increase in value of one's investment portfolio over the years